It is important to resolve all uncertain transactions before filing your GSTR1 return. If you do not, you may face penalties from the GST authorities.

Go to Reports > GST > GSTR-1.

TallyPrime 3.0 Reports GST GSTR-1 menu

TallyPrime 3.0 Reports GST GSTR-1 menuIn the Filters section, select the Uncertain Transactions (Corrections needed) option.

TallyPrime 3.0 GSTR-1 report filters uncertain transactions

Click Preview.

TallyPrime 3.0 GSTR-1 report preview uncertain transactions

TallyPrime 3.0 GSTR-1 report preview uncertain transactionsThe report will show all the transactions that have been marked as uncertain.

TallyPrime 3.0 GSTR-1 report uncertain transactions listFor each uncertain transaction, you will need to identify the error and resolve it. The following are some common errors and their resolutions:

- Invalid HSN/SAC code: The HSN/SAC code for the item is invalid. You can correct this by entering the correct HSN/SAC code in the item master.

TallyPrime 3.0 item master HSN/SAC code

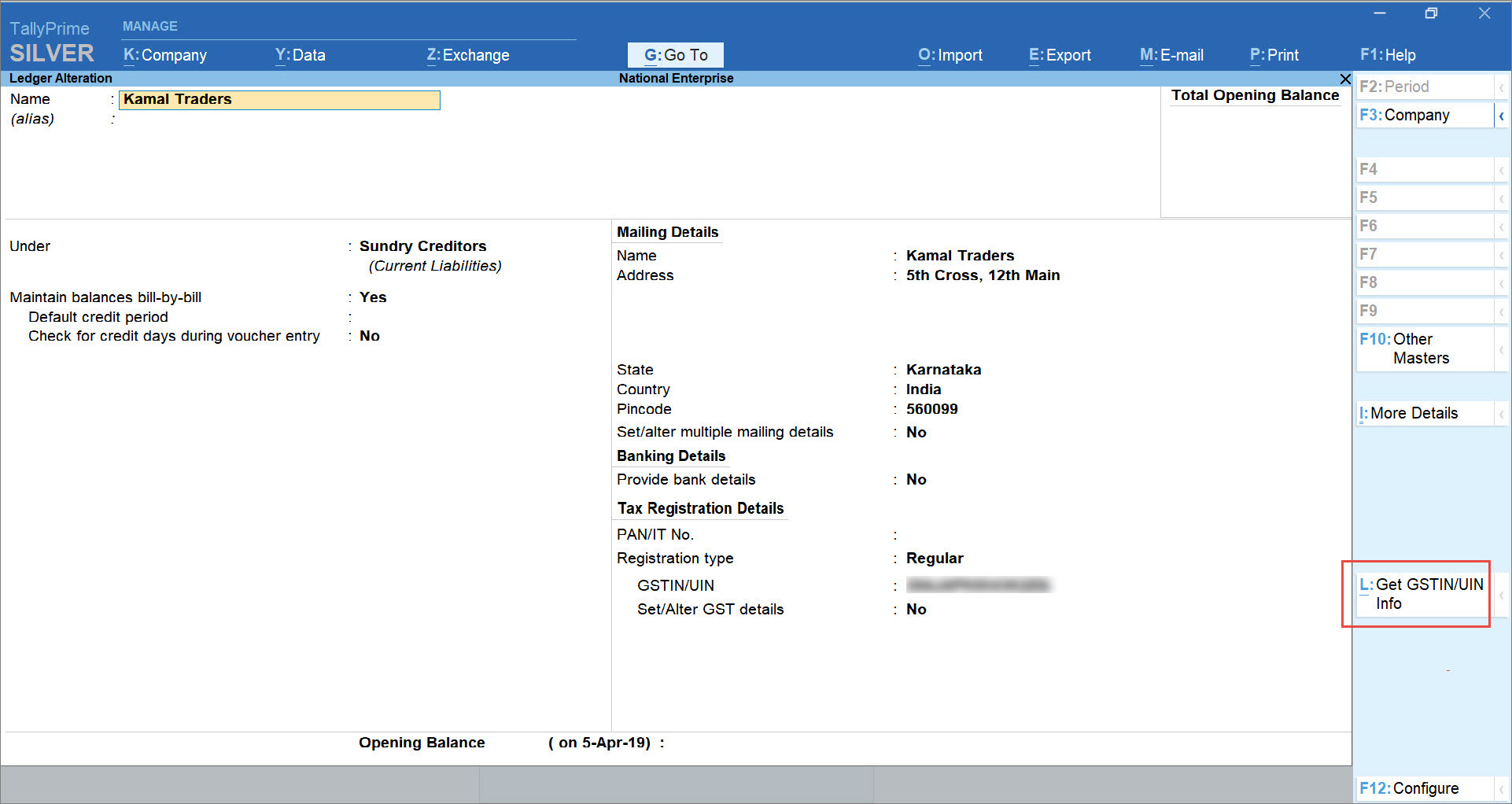

TallyPrime 3.0 item master HSN/SAC code- Missing GSTIN: The GSTIN of the supplier or customer is missing. You can correct this by entering the GSTIN in the party master.

TallyPrime 3.0 party master GSTIN

TallyPrime 3.0 party master GSTIN - Wrong tax rate: The tax rate for the transaction is wrong. You can correct this by entering the correct tax rate in the voucher.

TallyPrime 3.0 voucher tax rate

TallyPrime 3.0 voucher tax rate - Mismatch in quantity and amount: The quantity and amount for the transaction do not match. You can correct this by entering the correct quantity and amount in the voucher.TallyPrime 3.0 voucher quantity and amount

Once you have resolved all the errors, click Save to save the report.

TallyPrime 3.0 GSTR-1 report save

TallyPrime 3.0 GSTR-1 report saveThe uncertain transactions will now be removed from the report.

How to import data from Excel to Tally Prime Software

Tally Connect Software imports various types of vouchers like Sales Vouchers, Purchases Vouchers, Bank statements, Receipt Vouchers, Payment Vouchers, Journal Vouchers, E-Commerce, and Payroll Vouchers, and masters like Ledgers, Items, and Stock Journal from Excel to Tally Prime or Tally ERP9.

1- Prepare your data in a template by copying & pasting or by smart mapping

2-Validate Ledger, Items, Vouchers & Auto Create using TallyConnect software

3- Select template & start importing. After successful import, check data in Tally

Excel to Tally Prime / Excel to tally Prime3.0 import Software

“No Monthly Cost Pay Once Use Lifetime 100% Accuracy and Guaranteed Support”

Tally Connect Software imports various types of vouchers like Sales Vouchers, Purchases Vouchers, Bank statements, Receipt Vouchers, Payment Vouchers, Journal Vouchers, E-Commerce, and Payroll Vouchers, and masters like Ledgers, Items, and Stock Journal into Tally Prime /Prime3.0 or Tally ERP9.

# Import Multi GSTN data from 1 Template

# Import data in Multi GSTN Companies

# No XML import-export, direct Excel to Tally import

# Verify details of Ledger & Item master before import.

# Smart merging of the same invoices Number

# Import 25+ ledgers in 1 invoice

# Import e-commerce data with templates for Amazon, Flipkart, Meesho & more.

# Import Credit Note & Debit Note data with or without Inventory

# Import Stock Journal data

# Smart Data mapping feature to import data in Template file

# Auto Create GST ledger one-click by GSTN, place of supply, tax rate

# Multi Bill references & Multi cost centers as many as you can

# Import data of Employee Masters, Attendance Vouchers & Payroll Vouchers

# Import Multi-Currency data with Multi-currency Conversion

# Import Share Market data

# Import E-Invoicing data of Sale Credit note Vouchers

Sounds exciting then hurry up & contact us for Free Demonstration

watch our Software demo :https://www.youtube.com/@tallyconnects

Call us for free demo : 9322956608 / 9604339316

email : excelotallyprime@gmail.com

GET Free online Demo :https://www.exceltotallyprime.com/